Occupational pension scheme

Your BVV pension plan combines tax advantages with our excellent tariffs.

Pension system in Germany

Different to other countries

Germany's old-age pension system consists of three pillars. As the statutory part has been decreasing in the last years, occupational coverage today plays an important role and is sponsored by the government.

The standard retirement age in Germany is 67. However, an earlier or later start of retirement is possible.

How does it work?

In the finance sector, occupational pension plans are often salary-linked and jointly financed by the employer and employee. Depending on the rules agreed upon by BVV and your employer, in most cases you will automatically be registered at BVV by your employer. An annual pension statement will give you an overview of your benefits.

The government offers tax benefits: Contributions are generally paid from the gross income by deferred compensation, and are largely exempt from income tax and social insurance contributions for the employee.

Pensions are paid out worldwide and will be taxed during the retirement phase.

Example of deferred compensation

| Without deferred compensation | With deferred compensation | |

|---|---|---|

| Gross income | 3,500 EUR | 3,500 EUR |

| – amount paid to pension plan | – 0 EUR | – 200 EUR |

| = New gross income | = 3,500 EUR | = 3,300 EUR |

| – income tax | – 588 EUR | – 530 EUR |

| – social insurance levy | – 719 EUR | – 677 EUR |

| = Net income | = 2,193 EUR | = 2,093 EUR |

| (Figures are estimated) | ||

| >> If you pay 200 euros into your pension plan, you only invest approximately 100 euros from your net income. | ||

Why BVV?

Your advantages

- Excellent performance ratio

- No provisions or acquisition fees

- Tax benefits

- Pensions are paid worldwide

Larger than you think

Measured by its capital investment volume, BVV is Germany's largest pension institution.

(Status 31.12.2022)

| Founded | 1909 |

| Location | Berlin |

| Number of member companies | 761 |

| Number of insured persons and pensioners | 491,000 |

| Investment volume | approx. 33 billion euros |

| Administration expense ratio | 2.0 % |

| Staff | 286 employees |

| Executive Board | 3 members |

Products

BVV pension plan

In addition to the statutory pension insurance, your employer will offer you an occupational pension scheme by BVV. Details such as the chosen tariff and the amount of the contribution depend on the employer's agreement with BVV.

Basic pension coverage with employer's contribution

The employer will pay a wage-based monthly contribution to BVV. You as the employee may participate in the payment by way of deferred compensation. Each contribution will be credited to your personal BVV pension account.

BVV compact cover includes:

- Lifelong retirement pension

- Protection in the event of disability

- Surviving dependants' pension

Deferred compensation

You can increase your retirement pension individually, profiting from tax benefits and our excellent tariffs. Again, the tariffs offered by your employer may differ from the BVV product range displayed. The deferred compensation scheme is financed by you as the employee only.

Additional contribution from net income

There are even more options to increase your BVV pension. You can pay contributions without involving your employer. That is possible if you already have a BVV pension account.

When leaving the company

When leaving the company, you have the opportunity to increase your entitlement to benefits with your new employer (if they are located in Germany) or from your net income.

Your way to BVV

Next steps

- Be advised individually.

- Sign agreement with your employer.

- Employer signs you up at BVV.

- Receive an insurance cetificate.

- Be a member of BVV.

Individual advice

To arrange an individual consultation for your deferred compensation, simply select your desired date and time with the appointment calendar – our pension experts will call you on the time chosen.

Please indicate if you wish to receive advice in English.

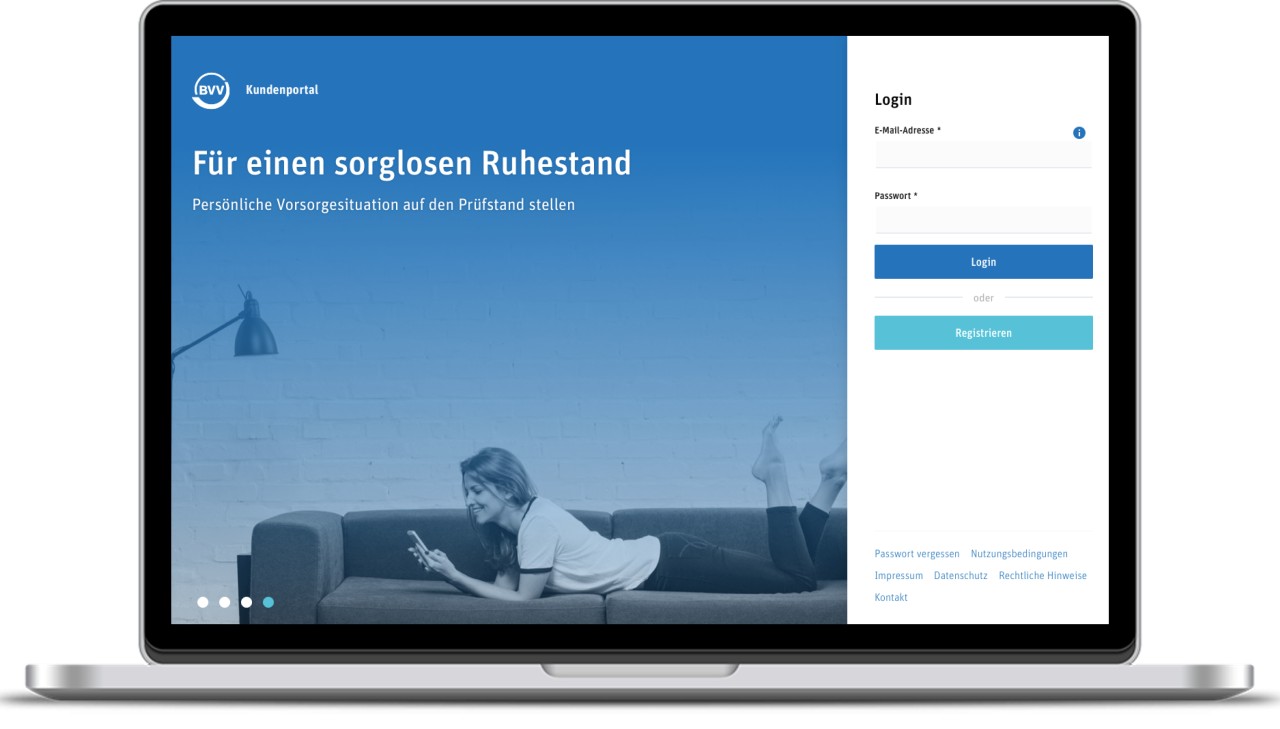

Customer portal (only in German)

Digital solution

We offer our customers an intuitive and modern digital solution for their company pension scheme.

All BVV customers now have digital access to their personal pension provision - at any time. Starting with the planning of the individual pension, comprehensible information and the latest news on the subject of old-age provision through to the arrangement of a personal consultation appointment.

- My pension plan

Every month we update your values and show you your achieved and projected entitlements. - My personal data

Let us know your new address or change your login data easily. - Advice by phone

Make an appointment with us to clarify questions that the portal does not answer.

Do you want to have an overview of your pensions contracts? Then sign up for our new customer portal.

The customer portal is currently only available in German.

Sie möchten uns lieber schreiben?

Nutzen Sie unser Kontaktformular.